Learn

What is a Risk Matrix?

A Risk Matrix is a crucial visual tool designed to evaluate and prioritise risks by their probability and impact. Utilising colour coding—green for low, yellow/orange for medium, and red for high risks—it offers a quick visual reference for stakeholders. Often termed a ‘risk assessment matrix’ or ‘risk grid mapping,’ this tool is integral to the risk assessment process, helping organisations navigate and manage potential risks effectively.

Learn more by clicking here to optimise your Risk Matrix.

Below, we present a selection of Risk Matrix examples, showcasing their application across diverse industries to illustrate how they can be tailored to meet specific risk assessment needs.

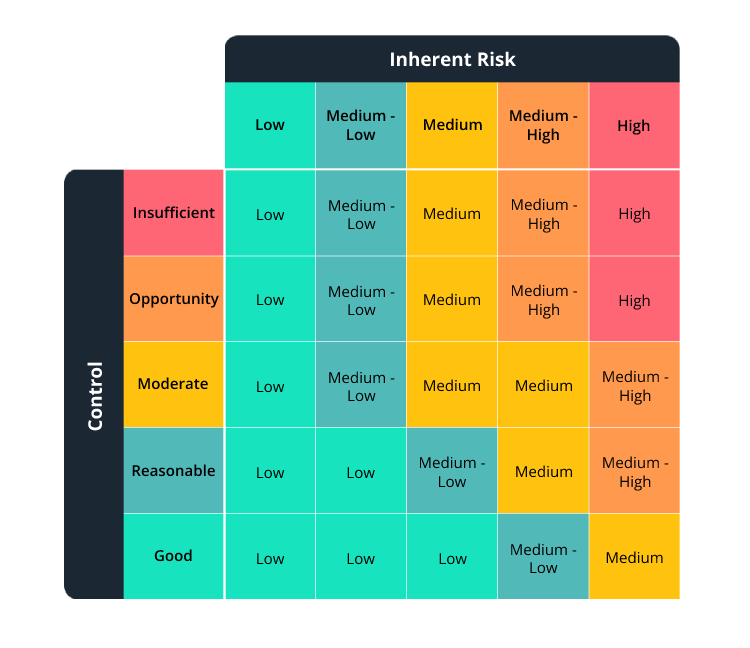

1. General Risk Management Matrix

The General Risk Management Matrix is a versatile tool applicable across various sectors for identifying and prioritising potential risks based on their likelihood and impact. This matrix uses a broad spectrum of labels, allowing for a nuanced assessment of risks. This wide-ranging approach ensures that it can accommodate different types of risks, whether they are strategic, operational, financial, or compliance-related, making it an essential tool for organisations aiming for comprehensive risk management.

- Project Management: For assessing risks associated with timelines, resources, and project outcomes.

- Healthcare Sector: To manage risks in patient care, data privacy, and healthcare delivery.

- Manufacturing Industry: For identifying risks in production processes, supply chain, and safety.

- Financial Services: To evaluate investment risks, market fluctuations, and compliance issues.

- Government and Public Services: In policy-making, emergency planning, and public safety measures.

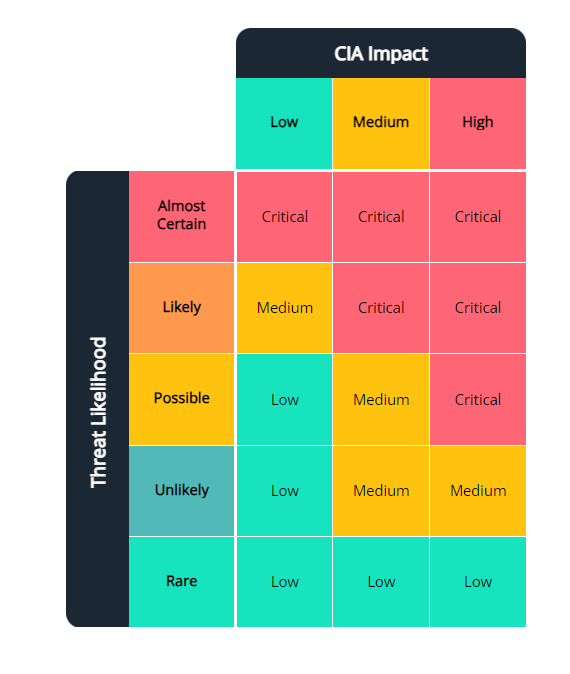

2. IT Security Risk Matrix

The IT Security Risk Matrix focuses on the specific needs of cybersecurity risk assessment, categorising risks based on Threat Likelihood and their Impact on the CIA (Confidentiality, Integrity, and Availability) triad. This specialised approach is tailored to the IT sector's unique challenges. It emphasises the importance of protecting information assets, ensuring that organisations can identify and act upon threats that could compromise their digital infrastructure.

- Cybersecurity Firms: For assessing vulnerabilities, threats, and cyber-attack likelihoods.

- Information Technology Departments: Across industries for managing data breaches, system integrity, and availability risks.

- Financial Institutions: To secure online banking services, customer data, and financial transactions.

- Healthcare Providers: For protecting patient records and ensuring the integrity of medical devices.

- E-commerce Platforms: To safeguard against data theft, fraud, and protect customer information.

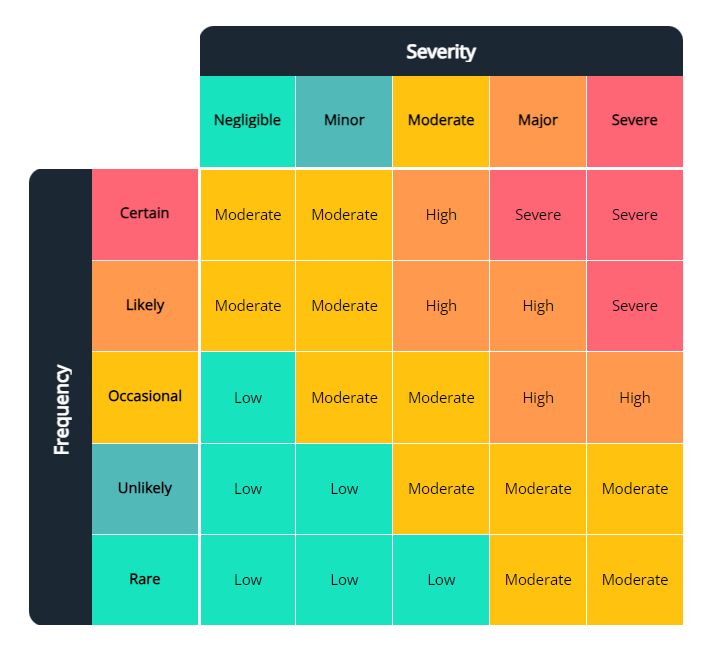

3. Environmental Risk Impact Matrix

Designed for industries and projects where environmental impact is a significant concern, the Environmental Risk Impact Matrix evaluates risks based on their Frequency and Severity of Environmental Impact. This matrix helps in pinpointing activities that could harm the environment. It guides organisations in prioritising actions to mitigate adverse environmental effects, reflecting the growing emphasis on sustainability and environmental stewardship.

- Construction and Real Estate: To evaluate and mitigate environmental impact of building projects.

- Oil, Gas, and Mining Industries: For managing risks related to spills, emissions, and environmental degradation.

- Agriculture and Forestry: To assess impacts on soil, water, and biodiversity from farming practices.

- Manufacturing Sector: In managing waste, emissions, and resource use to minimise environmental footprint.

- Government and Urban Planning: For sustainable development, conservation efforts, and environmental policy formulation.

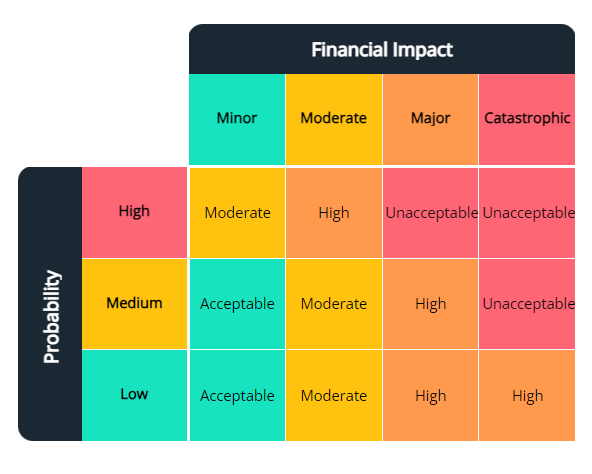

4. Financial Risk Assessment Matrix

The Financial Risk Assessment Matrix is tailored to evaluate risks that specifically affect financial outcomes, using Probability of Occurrence and Financial Impact as its axes. The labels, offer a focused framework for assessing financial risks. This matrix is crucial for financial institutions, investors, and businesses, aiding in the identification and management of risks that could influence financial stability or profitability.

- Banking Sector: For loan risk assessment, investment risk, and financial stability analysis.

- Investment Firms: In evaluating portfolio risks, market trends, and asset management strategies.

- Insurance Companies: To assess underwriting risks, claims probability, and financial solvency.

- Corporate Finance Departments: For managing operational costs, revenue forecasts, and investment decisions.

- Retail Businesses: In assessing risks related to cash flow, inventory management, and market demand.

5. Health and Safety Risk Rating Matrix

Taken from Wikipedia, this matrix is dedicated to assessing risks related to workplace health and safety, utilising Probability of Incident and Severity of Injury as the determining factors. The choice of labels are driven by the imperative to prevent accidents and health issues in the workplace. It's a vital tool for organisations committed to safeguarding their employees, allowing for the identification of potential hazards and the implementation of necessary safety measures to mitigate risk.

- Construction Industry: For identifying and mitigating workplace hazards, equipment safety, and on-site accidents.

- Manufacturing Plants: In managing risks related to machinery, hazardous materials, and workplace injuries.

- Hospitals and Healthcare Facilities: For patient safety, infection control, and medical procedure risks.

- Educational Institutions: In ensuring student and staff safety through emergency planning and risk management.

- Hospitality and Entertainment: To manage risks related to guest safety, food hygiene, and venue security.

Summary

Risk matrices are powerful tools in the landscape of risk assessments, offering a structured and visual approach to identifying, evaluating, and prioritising various types of risks across industries. For those looking to leverage this powerful tool tailored to their specific needs, RISKGRID provides an innovative solution. On RISKGRID, you have the flexibility to create your own risk matrix, fully customisable up to 9x9 dimensions. With the ability to customise labels for everything according to your organisation's risk appetite, RISKGRID empowers you to accurately assess and manage risks in alignment with your strategic goals. Visit our Risk Matrix Themes page to discover our creative colour schemes that can inspire your risk management matrix.